Audit Triggers

RED FLAGS

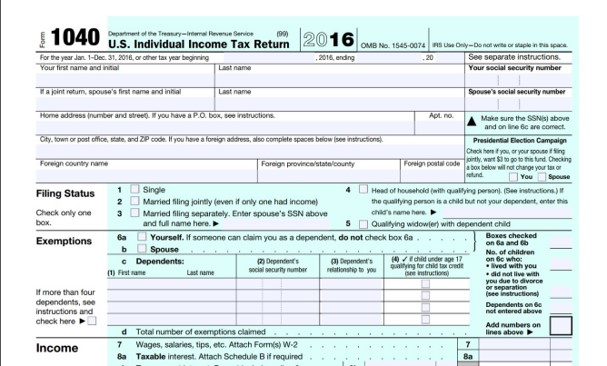

According to the IRS, returns are chosen for examination by computer scoring, information received from third party documentation (W-2, 1099 questionable treatment of an item), information received from other sources on potential non compliance (newspapers, public records and individuals).

A computer program called the Discriminant Inventory Function System (DIF) assigns a numeric score to each individual and some corporate tax returns after they have been processed. If your return is selected because of a high score under the DIF system, the potential is high that an examination of your return will result in a change to your income tax liability.

Your return may also be selected for examination on the basis of information received from third-party documentation, such as Forms 1099 and W-2, that do not match the information reported on your return.

AUDIT TRIGGERS

- Not Reporting all Taxable Income

- Data Entry Errors

- Participation in a Tax Shelter

- Rental Losses

- Failure to properly pay household help

- Large travel and entertainment expense

- Discrepancy Between Individual Taxpayers and Corporation Filings Associated to Taxpayer

- Self Employed (not reporting profit in 3 out of 5 years)

- Large charitable contributions

- Home office deductions

- Not Hiring a Reputable Tax Preparer

- Claiming 100% business use of a vehicle

ARE YOU QUALIFIED TO DO YOUR BUSINESS ACCOUNTING?

What you need to know about Essential Business Accounting