LBCPA News

Click here to go back

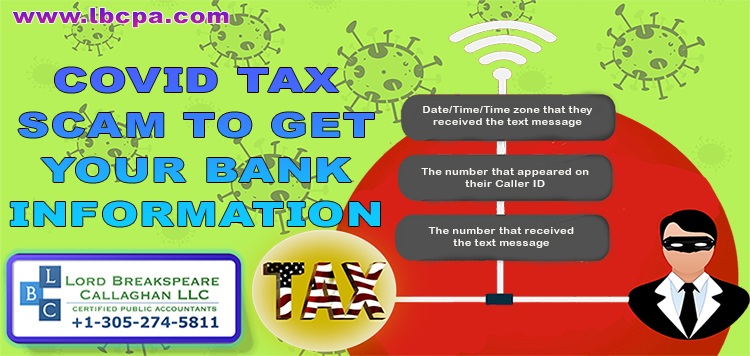

Security Summit partners warn taxpayers of new COVID-related text scam

The Internal Revenue Service, state tax agencies and the tax industry are warning of a new text scam created by thieves that trick people into disclosing bank account information under the guise of receiving the $1,200 Economic Impact Payment.

The IRS, states and industry, working together as the Security Summit, remind taxpayers that neither the IRS nor state agencies will ever text taxpayers asking for bank account information so that an EIP deposit may be made.

"Criminals are relentlessly using COVID-19 and Economic Impact Payments as cover to try to trick taxpayers out of their money or identities," said IRS Commissioner Chuck Rettig. "This scam is a new twist on those we've been seeing much of this year. We urge people to remain alert to these types of scams."

The scam text message states: "You have received a direct deposit of $1,200 from COVID-19 TREAS FUND. Further action is required to accept this payment into your account. Continue here to accept this payment …" The text includes a link to a fake phishing web address.

This fake phishing URL, which appears to come from a state agency or relief organization, takes recipients to a fraudulent website that impersonates the IRS.gov Get My Payment website. Individuals who visit the fraudulent website and then enter their personal and financial account information will have their information collected by these scammers.

People who receive this text scam should take a screen shot of the text message that they received and then include the screenshot in an email to phishing@irs.gov with the following information:

- Date/Time/Time zone that they received the text message

- The number that appeared on their Caller ID

- The number that received the text message

The IRS does not send unsolicited texts or emails. The IRS does not call people with threats of jail or lawsuits, nor does it demand tax payments on gift cards.

If you have any questions regarding accounting, domestic taxation, essential business accounting, international taxation, IRS representation, U.S. tax implications of Real Estate transactions or financial statements, please give us a call at 305-274-5811

Source: IRS